In double-entry bookkeeping, a widespread accounting method, all financial transactions are considered to affect at least two of a company’s accounts. One account will get a debit entry, while the second will get a credit entry to record each transaction that occurs. The accounting equation uses total assets, total liabilities, and total equity in the calculation. This formula differs from working capital, based on current assets and current liabilities.

Accounting Basics: T Accounts

In an LBO transaction, a company receives a loan from a private equity firm to fund the acquisition of a division of another company. Cash flows or the assets of the company being acquired usually secure the loan. Mezzanine debt is a private loan, usually provided by a commercial bank or a mezzanine venture capital firm. Mezzanine transactions often involve a mix of debt and equity in a subordinated loan or warrants, common stock, or preferred stock. Private equity generally refers to such an evaluation of companies that are not publicly traded.

Owner’s Draw vs. Salary: How to Pay Yourself

- It can be beneficial when you’re making journal entries, which is a way to track all the transactions that have happened in a business.

- This is posted to the Common Stock T-account on the credit side (right side).

- The next transaction figure of $100 is added directly below the January 12 record on the credit side.

- While T accounts are a valuable tool for understanding equity changes, they do have limitations that need to be considered.

- Accounting textbooks use two accounts with the word “Supplies”– Supplies (an asset), (sometimes called Supplies Asset), and Supplies Expense.

- In practice, this means an ownership stake of 20-50% in the other company.

For liabilities and equity accounts, however, debits always signify a decrease to the account, while credits always signify an increase to the account. In double-entry accounting or bookkeeping, total debits on the left side must equal total credits on the right side. That’s the case for each business transaction and journal entry.

How to Post Journal Entries to T-Accounts or Ledger Accounts

When cash will be paid later the account we use to track what the business will be paying later is Accounts Payable. Accounting textbooks use two accounts with the word “Supplies”– Supplies (an asset), (sometimes called Supplies Asset), and Supplies Expense. When supplies are used, they are moved from the asset account into the expense account. In the journal entry, Accounts Receivable has a debit https://www.facebook.com/BooksTimeInc/ of $5,500.

Let’s consider a hypothetical scenario where Company A decides to raise capital by either issuing new shares or taking out a loan. If Company A issues 10,000 shares at $10 per share, the equity account will increase by $100,000. On the other hand, if Company A borrows $100,000 from a bank, the equity account will remain unchanged. By analyzing these options using T accounts, it becomes evident that issuing new shares leads to an increase in equity, while borrowing does not impact equity directly. From an investor’s perspective, changes in equity reflect the return on investment and the potential for future earnings.

- Understanding equity and its changes is crucial for making informed investment decisions and assessing the financial viability of a company.

- A company can pay for something by either taking out debt (i.e. liabilities) or paying for it with money they own (i.e. equity).

- 11 Financial is a registered investment adviser located in Lufkin, Texas.

- Of the 50.4 million shares authorized, the company had issued roughly 15.5 million shares.

- These equity ownership benefits promote shareholders’ ongoing interest in the company.

- Business accounting is always about the flow of money or another value, and where that money ends up is what determines if it’s considered debited or credited.

You may not share, distribute, or resell the templates to anyone else in any way. Opened a business bank account with a deposit of $55,000 from personal funds. You have the following transactions the last few days of April. One of the most crucial aspects of running a successful business is managing credit risk. The requirements for the equity equity t account method are set out in both U.S.

T Accounts allows businesses that use double entry to distinguish easily between those debits and credits. The investee company will record a profit or loss for the period in its own income statement. Under the equity method, an investing company will recognize it’s share of the investee company profit or loss for the period in its own income statement. The share it recognizes will be it’s percentage ownership in the investee company.

What are Specific Names for Equity on the Balance Sheet?

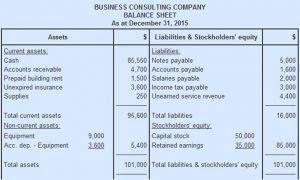

Current liabilities are short-term financial obligations payable in cash within a year. Current liabilities include accounts payable, accrued expenses, and the short-term portion of debt. The monthly trial balance is https://www.bookstime.com/ a listing of account names from the chart of accounts with total account balances or amounts. Total debits and credits must be equal before posting transactions to the general ledger for the accounting cycle. Liabilities are obligations that the company owes to external parties, such as loans, accounts payable, and accrued expenses.

- You will notice that the transactions from January 3, January 9, January 12, and January 14 are listed already in this T-account.

- After reviewing the transactions, prepare the necessary journal entries and post them to the necessary T- Accounts.

- Horizontal analysis involves comparing equity changes over multiple periods.

- You should use the equity accounting method if the reporting entity has a significant, but not controlling, interest in another company.

- Some call this value “brand equity,” which measures the value of a brand relative to a generic or store-brand version of a product.

Salvage Value – A Complete Guide for Businesses

You might own a 70% stake in the company while your partner owns 30%, for example. If you own an unincorporated small business, you already have equity. In this case, it’s just the value of all your assets (cash, equipment, etc.) minus all your liabilities . When an investment is publicly traded, the market value of equity is readily available by looking at the company’s share price and its market capitalization.

Add Your Comment