The firm may face difficulty in measuring profit due to transfer prices, joint revenue and common cost. This is because, in most manufacturing how does bidens latest plan to tax the superrich work its more straightforward firms, intra-company transactions take place. These sub-units are the smallest area of responsibility or segment of activity.

Invest in Employee Training – Strategies for Effective Management of Cost Centers

Transfer Price refers to the price we use to measure the total amount of goods and services that one profit centre supplies to another within the organization. This implies that when the internal transfer of goods and services occurs between different profit centres, its expression should be in terms of money. Hence, the monetary amount of inter-divisional transfers is the transfer price.

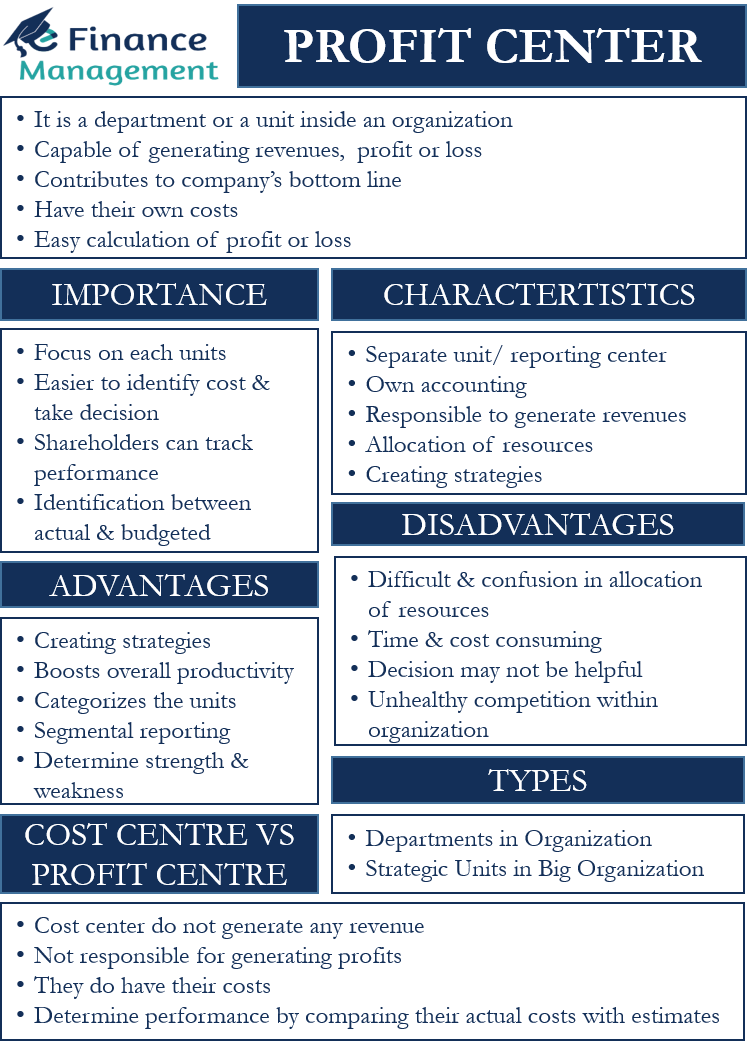

Cost Center vs Profit Center

- For example, we will call the marketing department a cost center because the company invests heavily in marketing.

- It can be achieved through process optimization, reducing waste, and eliminating unnecessary expenses.

- Still, it helps control the company’s costs (by understanding what customers are struggling with) and facilitates in reducing the costs of the organization.

- Even though Profit Centers are directly involved in so many core business operations they still can’t function in total isolation.

The primary purpose of a cost center is to track and allocate costs within an organization. By assigning costs to specific departments or units, management can monitor and control expenses more effectively. Cost centers provide insights into resource utilization and help identify areas where cost reductions or process improvements can be made. They enable organizations to make informed decisions about resource allocation and optimize operational efficiency. They provide insights into the financial performance of specific business units, enabling management to identify profitable areas and allocate resources accordingly.

Can cost centers and profit centers have different objectives?

On the other hand, a profit center is a unit that generates revenue and is accountable for both its costs and profits. It operates as a separate business entity within the company and has the goal of maximizing profits. While cost centers focus on cost control, profit centers focus on revenue generation and profitability.

For example, the customer service facilities may not create direct profits for the company. Still, it helps control the company’s costs (by understanding what customers are struggling with) and facilitates in reducing the costs of the organization. The difference is that here, in addition to being responsible for costs, the head of a profit centre will also be responsible for revenues. Transfer price is nothing but the value placed on the exchange of goods and services between two profit centres. And the way in which we determine this profit, will decide the profitability of the supplying (selling) and receiving (buying) profit centre. In this post, you will come to know the fundamental differences between cost centre and profit centre.

Performance measures appropriate to cost centres

However, in a decentralized company where the power and the responsibility are shared, you will see cost and profit centers. So a cost center helps a company identify the costs and reduce them as much as possible. And a profit center acts as a sub-division of a business because it controls the most important key factors of every business. Because managers take all the important decisions regarding product mix, promotion mix and technology used. A profit centre is a type of responsibility centre wherein the manager of the centre or unit is responsible for both cost and revenue for the asset assigned to the division. In this way, the measurement of both the elements, i.e. cost (input) and revenue (output) is in terms of money.

Both cost centers and profit centers are essentialto the functioning of a business. The efficient operation of a business is aresult of the combined working of several departments of a business. It allows profit centers to focus on maximizing revenue and profits while balancing the need to control costs and maintain operational efficiency. Each profit center is accountable for generating revenue, managing costs, and achieving profit targets independently. Cost centers are accountable for managing costs and expenses within budget while providing necessary support and services to other departments. The performance of cost centers is typically evaluated based on their ability to manage expenses effectively and efficiently while meeting the organization’s needs.

Cost centers and profit centers are both reasons a business becomes successful. A cost center is a subunit of a company that takes care of the costs of that unit. On the other hand, a profit center is a subunit of a company that is responsible for revenues, profits, and costs.

Add Your Comment